How Vehicle Ownership Laws Differ by U.S. State

Vehicle ownership laws in the United States are not uniform. Instead, each state regulates titles, registration, taxation, inspections, and consumer protections independently. Therefore, while the general framework of vehicle ownership is similar nationwide, the legal requirements can vary significantly depending on where a vehicle is registered.

Understanding how vehicle ownership laws differ by U.S. state is essential for buyers, sellers, and long-term owners. Additionally, these differences directly affect ownership costs, compliance obligations, and resale value.

How Vehicle Titles Differ by State

A vehicle title is the legal proof of ownership. However, the rules governing titles vary across jurisdictions.

Title Branding Standards

States use title brands to indicate a vehicle’s history. Although the terminology is often similar, definitions and thresholds differ.

Common title brands include:

- Salvage

- Rebuilt

- Flood Damage

- Lemon Law Buyback

- Odometer Disclosure

For example, one state may declare a vehicle salvage if repair costs exceed 75% of market value. Meanwhile, another state may use an 80% or 90% threshold. As a result, a vehicle branded in one state may have been classified differently elsewhere.

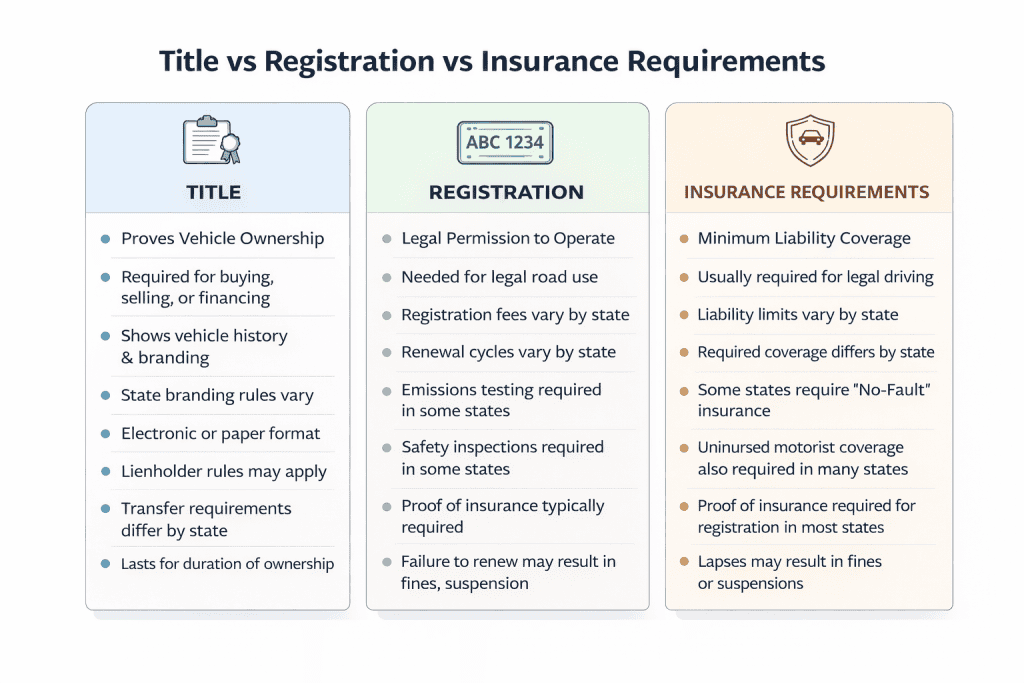

Infographic comparing vehicle title, registration, and insurance requirements in three columns,

highlighting ownership proof, legal operation rules, and state-specific coverage differences.

Additionally, rebuilt title inspection standards vary. Some states require extensive documentation and certified inspections, whereas others impose more limited review processes.

Electronic vs Paper Titles

Many states now issue electronic titles. However, not all states operate digital title systems. Consequently, transferring ownership between states may require converting an electronic title to a paper format.

How Vehicle Titles Differ by State

A vehicle title is the legal proof of ownership. However, the rules governing titles vary across jurisdictions.

Title Branding Standards

States use title brands to indicate a vehicle’s history. Although the terminology is often similar, definitions and thresholds differ.

Common title brands include:

- Salvage

- Rebuilt

- Flood Damage

- Lemon Law Buyback

- Odometer Disclosure

For example, one state may declare a vehicle salvage if repair costs exceed 75% of market value. Meanwhile, another state may use an 80% or 90% threshold. As a result, a vehicle branded in one state may have been classified differently elsewhere.

Additionally, rebuilt title inspection standards vary. Some states require extensive documentation and certified inspections, whereas others impose more limited review processes.

Electronic vs Paper Titles

Many states now issue electronic titles. However, not all states operate digital title systems. Consequently, transferring ownership between states may require converting an electronic title to a paper format.

How Registration Requirements Vary

Registration authorizes a vehicle for legal road use. Nevertheless, registration laws differ in several key ways.

Registration Fee Structures

States determine registration fees using different formulas:

- Flat annual fee

- Value-based fee

- Weight-based fee

- Age-based fee

- Combination formulas

For example, certain states calculate fees based on the vehicle’s current market value. Meanwhile, others charge declining fees as the vehicle ages. Therefore, two identical vehicles may have substantially different annual registration costs depending on location.

Renewal Cycles

Some states require annual renewal. Others use multi-year cycles. Additionally, renewal months may be tied to:

- Owner’s birth month

- Initial registration date

- Calendar year

Failure to renew on time can result in penalties, suspension of driving privileges, or impoundment.

How Vehicle Sales Tax Differs by State

Vehicle sales tax is another major ownership variable.

Most states apply sales tax at the time of purchase. However, rates vary widely, and certain states have no statewide vehicle sales tax. Furthermore, some states calculate tax based on purchase price, while others use book value or assessed value.

Additionally, trade-in credits may reduce taxable amounts in some jurisdictions but not in others. Therefore, understanding state-specific tax rules is critical before finalizing a purchase.

How Emissions and Safety Inspections Differ

Inspection requirements are among the most visible differences between states.

Emissions Testing

Some states mandate emissions testing in metropolitan areas only. Others require statewide testing. Meanwhile, a few states do not require emissions testing at all.

Requirements may include:

- Annual testing

- Biennial testing

- OBD-based diagnostics

- Tailpipe emissions measurement

Consequently, relocating to another state may require inspection before registration approval.

Safety Inspections

Certain states require annual safety inspections covering:

- Brakes

- Lights

- Tires

- Suspension

- Steering components

Other states do not mandate routine safety inspections. Therefore, compliance obligations depend entirely on state law.

How Insurance Requirements Differ by State

Minimum insurance coverage levels vary significantly.

States establish required liability limits. Additionally, some states operate under no-fault insurance systems, which alter how claims are processed after accidents.

Required coverage categories may include:

- Bodily injury liability

- Property damage liability

- Uninsured motorist coverage

- Personal injury protection (PIP)

Because minimum coverage thresholds differ, insurance premiums and legal obligations vary accordingly.

How Lemon Laws and Consumer Protections Differ

Lemon laws protect buyers of defective vehicles. However, each state defines its own standards.

State differences may include:

- Time limits for filing claims

- Mileage thresholds

- Required number of repair attempts

- Coverage for used vehicles

Therefore, consumer protection strength varies depending on jurisdiction.

How Moving Between States Affects Ownership

Relocating triggers new compliance requirements.

Most states require new residents to:

- Transfer registration

- Update title information

- Obtain state-compliant insurance

- Complete inspections (if required)

Deadlines often range from 30 to 90 days. Consequently, failing to comply promptly may result in fines or registration suspension.

Additionally, vehicle taxation and registration costs may change after relocation.

How Property Taxes on Vehicles Differ

Some states impose annual property taxes on vehicles based on assessed value. Others do not tax vehicles beyond registration fees.

For example, certain states calculate personal property tax annually, which increases total ownership costs. Meanwhile, other states rely solely on registration fees.

Therefore, long-term ownership expenses vary considerably by state.

Why State Differences Matter for Vehicle Owners

State-specific ownership laws affect more than paperwork. They influence:

- Annual operating costs

- Transfer complexity

- Resale value

- Insurance obligations

- Inspection compliance

Additionally, buying or selling across state lines introduces further complexity. Consequently, owners should verify state-specific rules before completing transactions.

Understanding how vehicle ownership laws differ by U.S. state helps prevent administrative issues and ensures ongoing compliance.

Related Guides

Add a comment Cancel reply

Categories

Recent Posts

About us

Related posts

How Federal and State Lemon Laws Protect Car Buyers From Defective Vehicles

How Safety Inspections vs Emissions Inspections Work in the U.S.

How Emissions Testing Requirements Work by U.S. State

- Guides

- Vehicle Research

- Tools

- Company

- Buying Guides

- Vehicle Reviews

- Fuel Cost calculator

- About Us

- Maintenance Guides

- Vehicle News

- Maintenance Cost Calculator

- Contact

- Repair Guides

- Towing & Payload Guides

- Repair Cost Estimator

- Privacy

- Ownership Guides

- Fuel Economy Guides

- Ownership Cost Calculator

- Terms

- Depreciation Guides

- Reliability & Ownership

- Trade-In Value Estimator

- Disclaimer

- Depreciation Calculator

- Loan / Payment Calculator