How Vehicle Depreciation Really Works After Purchase

Vehicle depreciation is one of the largest hidden ownership costs drivers face after buying a car. Although fuel, insurance, and maintenance receive most of the attention, depreciation often costs owners far more over time. Understanding how depreciation works after purchase helps drivers predict resale value, choose ownership timing wisely, and avoid expensive financial surprises later.

This guide breaks down how depreciation actually progresses, what factors accelerate value loss, and how owners can manage depreciation risk throughout the life of the vehicle.

What Vehicle Depreciation Means in Practical Ownership Terms

Depreciation is the reduction in a vehicle’s market value over time due to age, mileage, condition, market demand, and technological obsolescence. However, depreciation does not happen evenly. Instead, most vehicles lose value rapidly in the early years and then decline more gradually afterward.

Because resale value depends on real market demand rather than original purchase price, two vehicles bought for the same amount can depreciate very differently depending on reliability reputation, trim level, and long-term maintenance history.

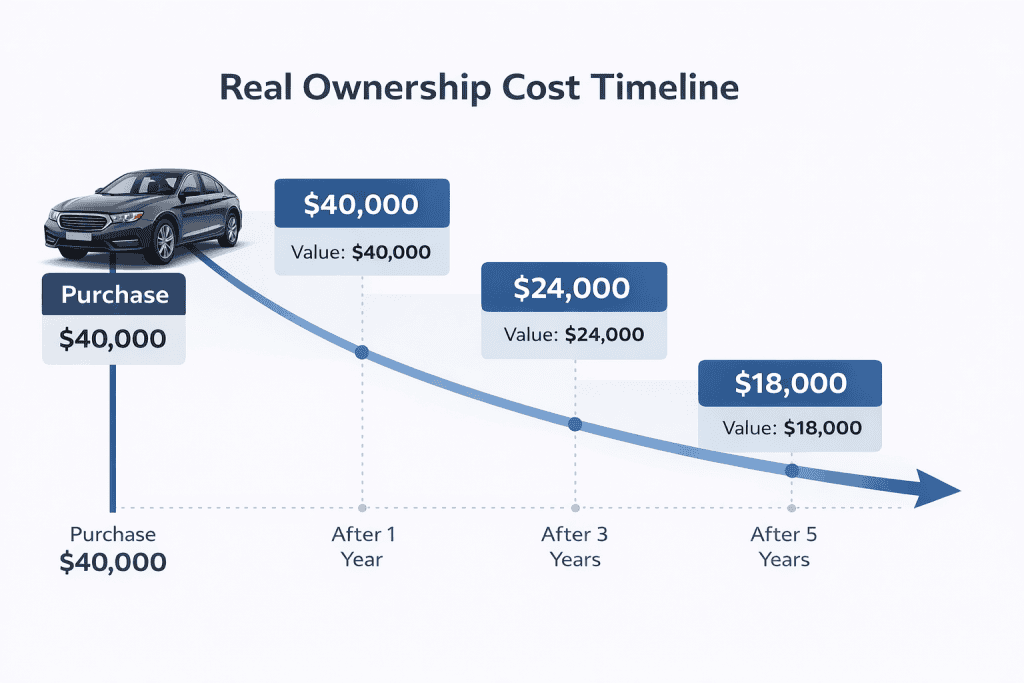

Car depreciation timeline showing value decline from $40,000 purchase to $18,000 after five years.

Although exact numbers vary by model and market conditions, the general depreciation pattern follows a predictable structure.

First year after purchase

Most vehicles lose the largest portion of value in the first year. This drop occurs because once the car is titled and driven, it is no longer considered new. Buyers expect a significant discount compared to a factory-new vehicle.

Years two through four

Depreciation continues at a slower but still noticeable rate. During this period:

- warranty coverage may begin expiring

- mileage accumulation becomes more important

- newer competing models enter the market

Because buyers compare used vehicles against newer technology and refreshed designs, mid-ownership depreciation often reflects market competition rather than mechanical condition alone.

Years five and beyond

Depreciation generally stabilizes. At this stage:

- the vehicle’s reputation for reliability matters heavily

- maintenance records influence resale price

- overall condition becomes more important than model year

Vehicles with strong reliability histories often retain value better in this phase, while models known for expensive repairs may decline faster.

Why New Vehicles Lose Value Immediately After Purchase

The immediate post-purchase drop in value is driven by several structural market factors.

Retail versus wholesale pricing difference

Dealership purchase prices include:

- reconditioning costs

- advertising expenses

- warranty coverage

- dealer margin

Once the vehicle leaves the dealership, resale value reflects wholesale market reality rather than retail pricing.

Buyer risk perception

Used vehicle buyers assume higher risk than new-vehicle buyers. Even low-mileage vehicles must be priced lower to compensate for uncertainty regarding prior use, maintenance habits, and unseen wear.

Technology replacement cycles

Modern vehicles evolve quickly in safety systems, infotainment platforms, and driver-assistance features. As a result, last year’s model may feel outdated faster than in previous decades, accelerating early depreciation.

How Mileage Influences Post-Purchase Depreciation

Mileage is one of the strongest predictors of resale value. However, depreciation does not increase linearly with miles driven.

Instead, market psychology creates mileage thresholds.

For example:

- vehicles under typical annual mileage ranges often retain stronger resale value

- vehicles significantly above expected mileage may see sharper price reductions

- extremely low mileage can also raise buyer concerns about long-term storage effects

Because buyers often compare listings using mileage filters, even moderate differences in odometer readings can significantly influence perceived value.

How Vehicle Condition Impacts Resale Value Over Time

Mechanical condition, cosmetic appearance, and maintenance history collectively determine how much depreciation actually affects an individual vehicle.

Important condition factors include:

Maintenance documentation

Vehicles with complete service records typically sell faster and closer to market value because buyers view documented maintenance as evidence of responsible ownership.

Exterior and interior wear

Paint damage, interior deterioration, and accident history can reduce resale value significantly because repairs often cost more than buyers expect.

Mechanical reliability perception

Even when a vehicle runs properly, models known for costly failures often depreciate faster due to buyer caution regarding potential future repairs.

How Trim Levels and Options Affect Long-Term Value

Not all features improve resale value equally.

Some options retain value well because they improve long-term usability, while others lose value quickly as technology advances.

Features that often help resale stability include:

- safety packages

- all-wheel drive systems in appropriate climates

- widely desired convenience upgrades

Features that typically depreciate faster include:

- outdated infotainment systems

- niche luxury upgrades with limited buyer demand

- expensive cosmetic packages

Because used buyers prioritize reliability and practicality, functional features often matter more than premium appearance upgrades when depreciation is evaluated years later.

How Market Demand Shapes Real Depreciation Outcomes

Vehicle depreciation is not determined solely by age or mileage. Broader market forces also influence resale value.

These forces include:

- fuel price trends affecting demand for large versus efficient vehicles

- reputation shifts caused by recalls or reliability reports

- changes in consumer preference toward hybrid or electric powertrains

- seasonal buying patterns

Because depreciation reflects supply and demand, two identical vehicles may sell for different prices depending on regional demand and timing.

How Owners Can Reduce Depreciation Impact

While depreciation cannot be eliminated, owners can reduce its financial impact through practical ownership decisions.

Maintain consistent service intervals

Regular maintenance reduces mechanical risk perception for future buyers and helps preserve value.

Avoid unnecessary cosmetic damage

Interior wear, paint scratches, and wheel damage often reduce resale value disproportionately compared to repair cost.

Keep documentation organized

Complete ownership records improve buyer confidence and may shorten selling time.

Choose selling timing carefully

Selling before major maintenance milestones or warranty expiration can sometimes improve resale outcomes because buyers expect fewer immediate expenses.

Why Understanding Depreciation Matters for Ownership Planning

Depreciation affects:

- trade-in decisions

- lease versus purchase comparisons

- long-term ownership budgeting

- replacement timing

Because depreciation often exceeds fuel and maintenance costs combined in early ownership years, evaluating expected value loss helps drivers plan financially and choose vehicles aligned with long-term ownership goals.

When owners understand how depreciation progresses after purchase, they can make more informed decisions about how long to keep a vehicle, when to sell, and how to protect resale value over time.

Related Tools & Guides:

Add a comment Cancel reply

Comments (0)

How to Choose Between a New or Used Car - Flip Cars

[…] depreciation begins immediately. Industry data shows that many new vehicles lose 20–30% of their value in the first year alone, and roughly 50–60% within five years. This means the largest ownership cost for new vehicles is […]

Categories

Recent Posts

About us

Related posts

How Extended Warranties Work and When They Pay Off

How Driving Habits Affect Long-Term Vehicle Reliability

How “As-Is” Vehicle Sales Work in the U.S.

- Guides

- Vehicle Research

- Tools

- Company

- Buying Guides

- Vehicle Reviews

- Fuel Cost calculator

- About Us

- Maintenance Guides

- Vehicle News

- Maintenance Cost Calculator

- Contact

- Repair Guides

- Towing & Payload Guides

- Repair Cost Estimator

- Privacy

- Ownership Guides

- Fuel Economy Guides

- Ownership Cost Calculator

- Terms

- Depreciation Guides

- Reliability & Ownership

- Trade-In Value Estimator

- Disclaimer

- Depreciation Calculator

- Loan / Payment Calculator